Videos

Originally aired on June 02, 2023

How the government’s crypto purge is getting a lot worse!

The European Union has signed the MiCA law into law, which enforces licensing and anti-money laundering rules for cryptocurrency-related businesses. This move makes the EU the first major jurisdiction to have tailored crypto regulation.

What is the MiCA law and what impact will it have on the cryptocurrency industry?

- The MiCA law enforces licensing and anti-money laundering rules for cryptocurrency-related businesses in the European Union.

- The law aims to reduce money laundering and terrorism financing risks associated with cryptocurrency transactions and ensure consumer protection.

- It will require companies to be authorized to operate in the EU and adhere to rules around capital and investor protection.

- It will also introduce a regime for stablecoins, classifying them as e-money, and imposing capital requirements and investor protection rules.

- The law is expected to level the playing field for crypto businesses in the EU, as it will be applicable to both EU-based and non-EU-based companies.

- However, the law has received criticism from some in the industry who believe it is too restrictive and could stifle innovation.

GUESTS:

Brooke Lacey

brookejlacey.com

https://twitter.com/brookejlacey

Matthew McKeon

https://twitter.com/samuraimckeon

Dylan

00:00 – Intro

00:40 – Guest intros

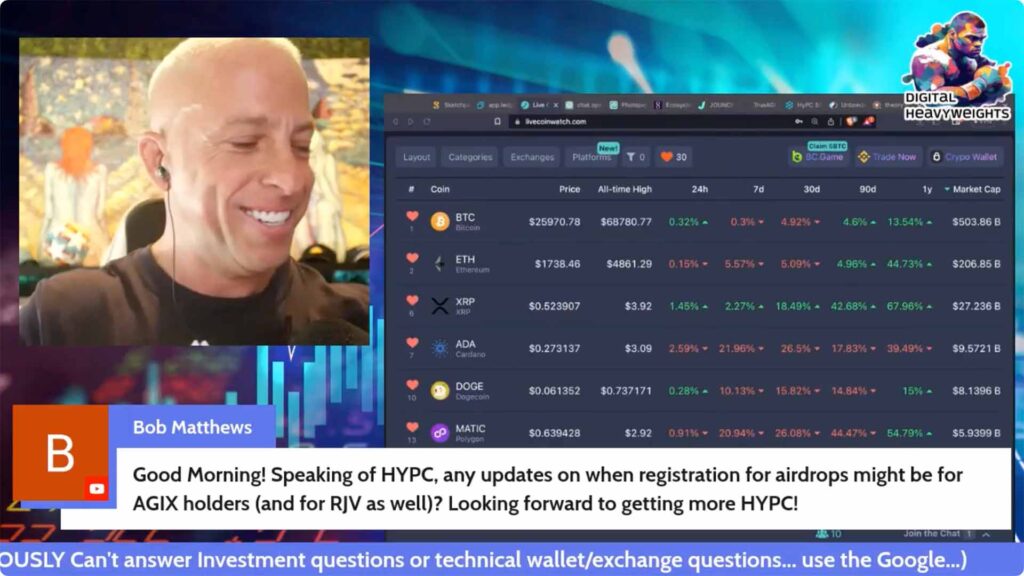

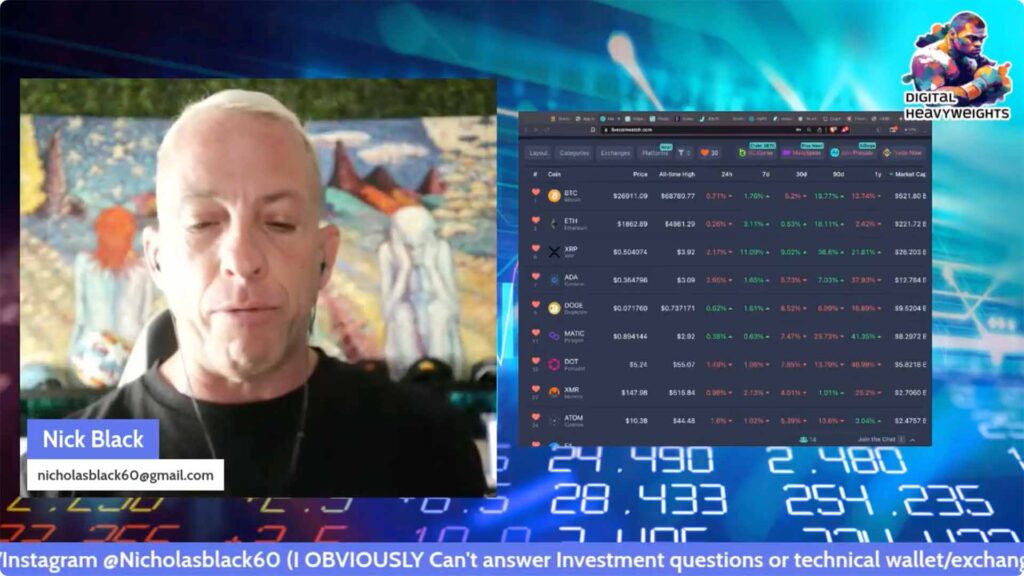

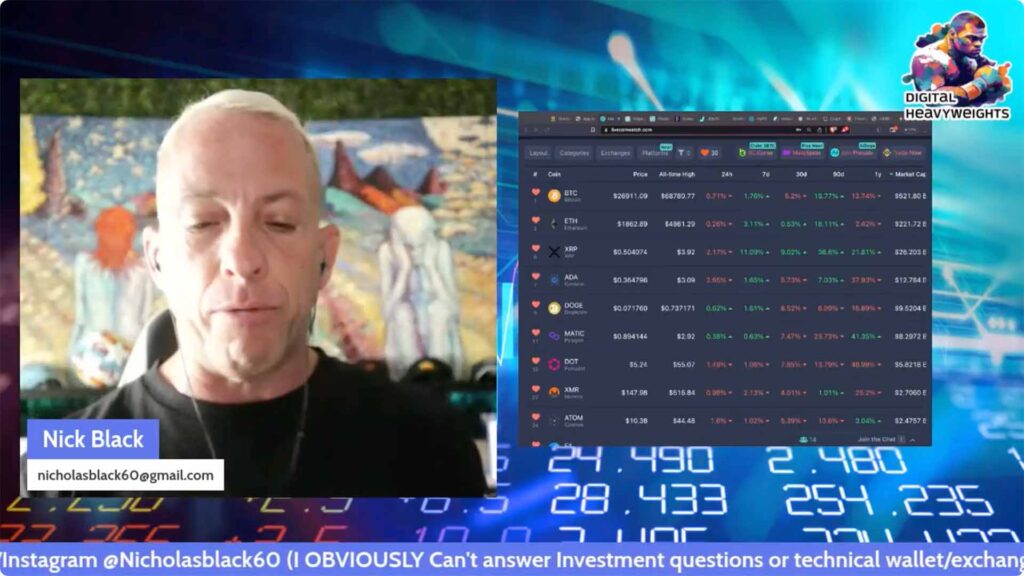

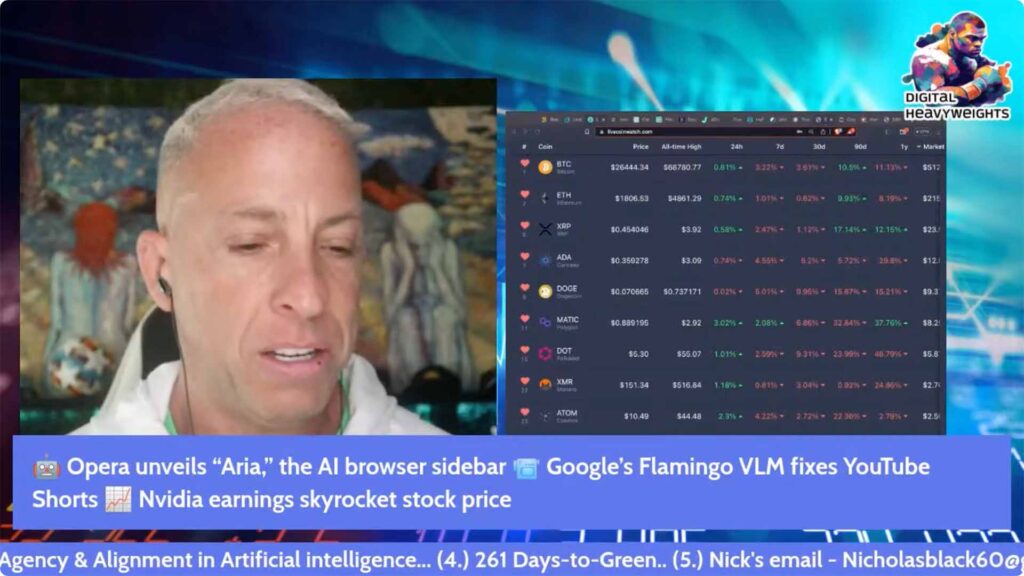

04:15 – The entire crypto market

04:35 – BTC daily

05:25 – Ripple social activity surges

08:45 – EU signs MiCA regulations

17:20 – IRS collecting data from Coinbase

32:40 – Cardano Lace wallet now open source

33:25 – Quantum PoW consensus for blockchain

42:35 – Follow today’s guests xoxo